Blessing in disguise

Books for Entrepreneurs

Documentary

eChai Wall of Love

How I Met My Co-Founder

In Focus Today

Insight Reports

Movies for Entrepreneurs

Notes from Podcasts

Slice of Startup Life

The First Hire

The First Welcome in Silicon Valley

The Reading Room

Unforgettable Lessons

The Social Architects of an Experience-Led World

Across cities, belonging is taking shape through smaller, more intentional communities. People are spending time in neighbourhood circles, interest-led groups, and shared experiences that bring them into closer conversation with others who are navigating similar questions about work, relationships, and direction.

Within these settings, conversation often becomes a place where people think more clearly about their lives. An evening spent with the right mix of people can stay in someone’s mind for months. A thoughtful exchange can influence how a person approaches a partnership, a career decision, or a commitment that unfolds gradually over time.

This is where social architects play an important role. They design intentional human gatherings with a clear purpose. They think carefully about who should be in the same setting, how the interaction should flow, and what kind of environment will help people speak with honesty and listen with attention. Their work shapes how modern communities form and how individuals move forward with greater self-understanding.

Radhika Mohta offers one example of this role in practice. Through structured relationship programs and curated gatherings, she creates experiences where people explore compatibility and emotional readiness with reflection and care. Many participants leave with insights that continue to influence their personal choices long after the gathering ends.

I have noticed a similar purpose in how she curates eChai startup meetups in Bengaluru. These gatherings bring founders together with a shared purpose. The conversations are guided in a way that helps people move beyond surface updates and talk about what they are truly navigating.

There are many others doing similar work across cities and communities. The formats may evolve. Groups may shift. People move on to different phases of life. Yet the lived experience of having once been part of a meaningful gathering often leaves a lasting imprint on the individual. That influence does not always show up when people try to measure the long-term value of a community or event, yet it continues to shape decisions, confidence, and direction in quiet and lasting ways.

For founders and builders working across technology and society, these experiences become part of how they think about trust, alignment, and community in their own work. The way they form teams or engage with users is shaped by moments where they themselves experienced meaningful dialogue.

Seen at a broader scale, social architects support the flow of human connection in a time of constant change. They help people find one another with intention. They create the conditions where reflection can lead to thoughtful action.

As life becomes increasingly digital, this kind of work keeps human interaction grounded and present, ensuring that communities continue to grow through shared understanding and lived experience.

Within these settings, conversation often becomes a place where people think more clearly about their lives. An evening spent with the right mix of people can stay in someone’s mind for months. A thoughtful exchange can influence how a person approaches a partnership, a career decision, or a commitment that unfolds gradually over time.

This is where social architects play an important role. They design intentional human gatherings with a clear purpose. They think carefully about who should be in the same setting, how the interaction should flow, and what kind of environment will help people speak with honesty and listen with attention. Their work shapes how modern communities form and how individuals move forward with greater self-understanding.

Radhika Mohta offers one example of this role in practice. Through structured relationship programs and curated gatherings, she creates experiences where people explore compatibility and emotional readiness with reflection and care. Many participants leave with insights that continue to influence their personal choices long after the gathering ends.

I have noticed a similar purpose in how she curates eChai startup meetups in Bengaluru. These gatherings bring founders together with a shared purpose. The conversations are guided in a way that helps people move beyond surface updates and talk about what they are truly navigating.

There are many others doing similar work across cities and communities. The formats may evolve. Groups may shift. People move on to different phases of life. Yet the lived experience of having once been part of a meaningful gathering often leaves a lasting imprint on the individual. That influence does not always show up when people try to measure the long-term value of a community or event, yet it continues to shape decisions, confidence, and direction in quiet and lasting ways.

For founders and builders working across technology and society, these experiences become part of how they think about trust, alignment, and community in their own work. The way they form teams or engage with users is shaped by moments where they themselves experienced meaningful dialogue.

Seen at a broader scale, social architects support the flow of human connection in a time of constant change. They help people find one another with intention. They create the conditions where reflection can lead to thoughtful action.

As life becomes increasingly digital, this kind of work keeps human interaction grounded and present, ensuring that communities continue to grow through shared understanding and lived experience.

When the City Becomes the Meeting Room

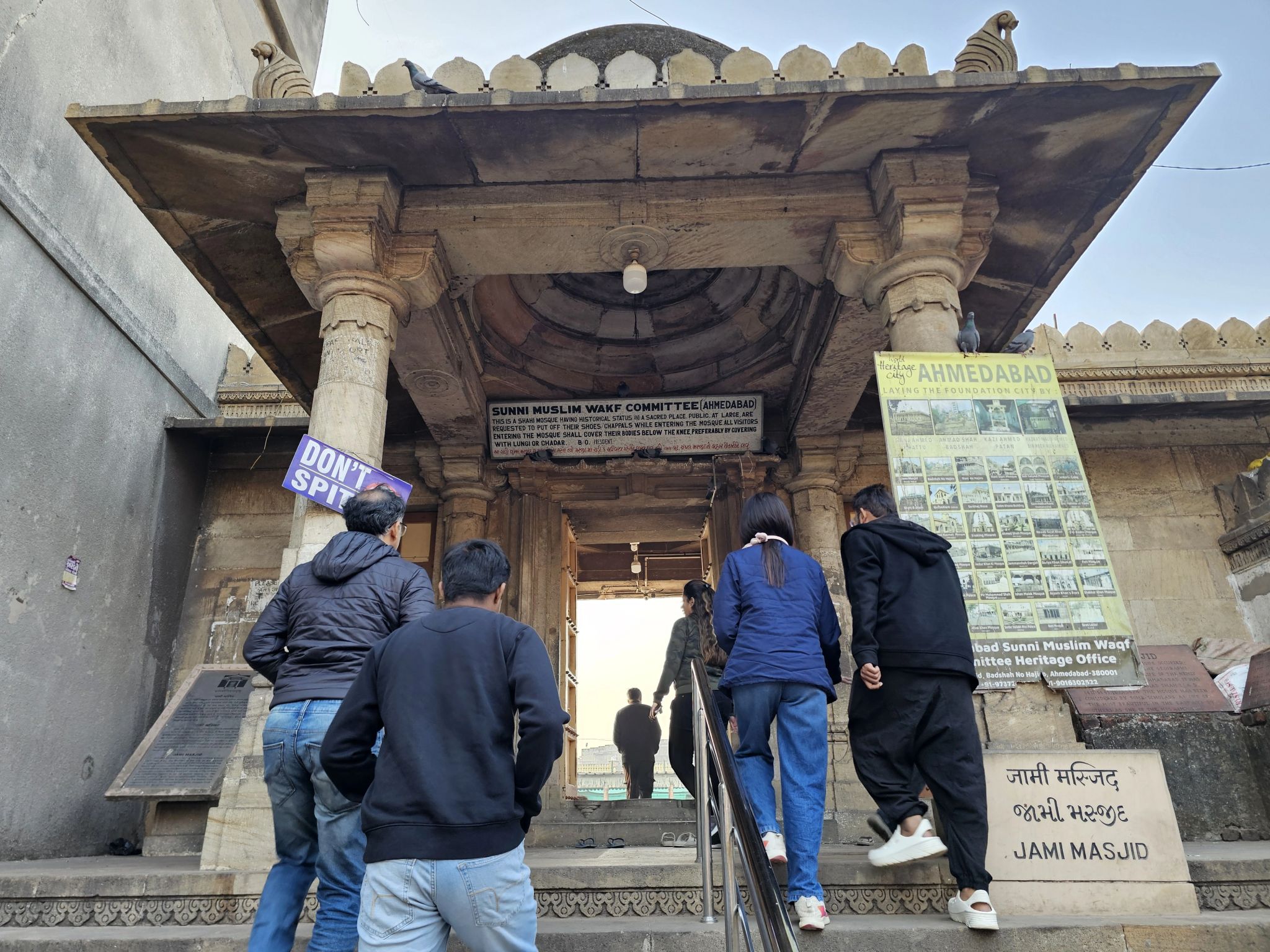

Being part of today’s eChai Ventures Heritage Founders Walk in Ahmedabad was a powerful reminder of why this city holds such global and personal significance.

Ahmedabad is not just a growing urban centre. It is India’s first UNESCO World Heritage City, a place where centuries of architecture, craft, community living, and cultural memory continue to coexist with modern ambitions.

As part of the founders’ initiative it is a way for founders and professionals to step out of meeting rooms and screens, and into the living fabric of the city.

Walking through the pols, temples, mosques, chowks, and bylanes, we didn’t just encounter heritage structures, we encountered stories, livelihoods, restoration efforts, local entrepreneurship, and people who are preserving, reinterpreting, and reshaping the old city in their own ways.

Conversations unfolded naturally about work, ideas, urban challenges, culture, startups, conservation, and community over khaman, jalebi and chai of famous Chandravilas palace, another heritage food outlet of Amdavad.

In a UNESCO World Heritage City, heritage is not meant to be observed from a distance. It is meant to be walked, listened to, and lived with.

Grateful to be part of a founders’ community that believes city-building begins with understanding the city first.

As I have been part of Heritage walk over the years, I can see & observe the transformation of the living heritage of the city. The lanes are getting paved, the facades getting restored and the living heritage trying hard to keep pace with changing surroundings.

And a great way to start new year 2026 !

The walk was conducted by Dhaumil Parmar.

Ahmedabad is not just a growing urban centre. It is India’s first UNESCO World Heritage City, a place where centuries of architecture, craft, community living, and cultural memory continue to coexist with modern ambitions.

As part of the founders’ initiative it is a way for founders and professionals to step out of meeting rooms and screens, and into the living fabric of the city.

Walking through the pols, temples, mosques, chowks, and bylanes, we didn’t just encounter heritage structures, we encountered stories, livelihoods, restoration efforts, local entrepreneurship, and people who are preserving, reinterpreting, and reshaping the old city in their own ways.

Conversations unfolded naturally about work, ideas, urban challenges, culture, startups, conservation, and community over khaman, jalebi and chai of famous Chandravilas palace, another heritage food outlet of Amdavad.

In a UNESCO World Heritage City, heritage is not meant to be observed from a distance. It is meant to be walked, listened to, and lived with.

Grateful to be part of a founders’ community that believes city-building begins with understanding the city first.

As I have been part of Heritage walk over the years, I can see & observe the transformation of the living heritage of the city. The lanes are getting paved, the facades getting restored and the living heritage trying hard to keep pace with changing surroundings.

And a great way to start new year 2026 !

The walk was conducted by Dhaumil Parmar.

Design Thinking in Practice - Notes from an eChai Design Meetup in Ahmedabad

.jpg)

“Design thinking isn’t a buzzword anymore. It’s becoming a core leadership skill.” 💡

Last month, I had the joy of speaking at the eChai Ventures Ahmedabad Design Meetup at the beautiful iHub premises in Ahmedabad. I must say this campus has a personality of itself. The aura of the space itself invites creativity and innovation. The audience had settled down and the speakers were just starting the introductions.

On stage with me were fellow women founders and designers, Kushboo Shah (Principal Designer, Studio Juxta), Drashti Vora (Partner at Studuo - Branding & UI/UX), Sheel Damani (Founder and Principal Strategist, Fruitfly Design), Isha Nadkarni Talsania (Co-founder Future Learning Circles), Rujuta Shah (Founder - Studio Oblique) who are quietly (and boldly) shaping the next wave of digital products.

Big credit to Jatin Chaudhary for putting together such a well-structured and purposeful meetup. Events like this only happen when there’s real intent and strong execution behind them.

We shared stories from nuances of real‑world projects: launches that created impact, projects that gave freedom to experiment, and moments where a single user interview or a question or the persistence to keep going changed the entire roadmap.

What stayed with me was the curiosity in the room.

“Where do you draw the line between business asks and user needs?”

“How do I find a way to express my creative way in my work which comes with constraints of its own?”

“What are the practical ways in which AI has helped you in your process?”

These weren’t theoretical questions; they came from product owners, founders, and designers wrestling with live products and real constraints.

The takeaways were crisp and actionable. It was inspiring to see design thinking applied across such a wide spectrum—healthcare, fintech, SaaS, education—and to feel how powerful it becomes when teams truly put humans at the center of every decision. 🧠✨

If you’re designing products today, design thinking isn’t a “nice to have” anymore—it’s your competitive edge.

Were you at the meetup, or have a story where design thinking changed your product’s direction?

👇 Share your experience in the comments, and if you’d like to swap notes or collaborate on human‑centered product journeys, let’s connect. 💬✨

Last month, I had the joy of speaking at the eChai Ventures Ahmedabad Design Meetup at the beautiful iHub premises in Ahmedabad. I must say this campus has a personality of itself. The aura of the space itself invites creativity and innovation. The audience had settled down and the speakers were just starting the introductions.

On stage with me were fellow women founders and designers, Kushboo Shah (Principal Designer, Studio Juxta), Drashti Vora (Partner at Studuo - Branding & UI/UX), Sheel Damani (Founder and Principal Strategist, Fruitfly Design), Isha Nadkarni Talsania (Co-founder Future Learning Circles), Rujuta Shah (Founder - Studio Oblique) who are quietly (and boldly) shaping the next wave of digital products.

Big credit to Jatin Chaudhary for putting together such a well-structured and purposeful meetup. Events like this only happen when there’s real intent and strong execution behind them.

We shared stories from nuances of real‑world projects: launches that created impact, projects that gave freedom to experiment, and moments where a single user interview or a question or the persistence to keep going changed the entire roadmap.

What stayed with me was the curiosity in the room.

“Where do you draw the line between business asks and user needs?”

“How do I find a way to express my creative way in my work which comes with constraints of its own?”

“What are the practical ways in which AI has helped you in your process?”

These weren’t theoretical questions; they came from product owners, founders, and designers wrestling with live products and real constraints.

The takeaways were crisp and actionable. It was inspiring to see design thinking applied across such a wide spectrum—healthcare, fintech, SaaS, education—and to feel how powerful it becomes when teams truly put humans at the center of every decision. 🧠✨

If you’re designing products today, design thinking isn’t a “nice to have” anymore—it’s your competitive edge.

Were you at the meetup, or have a story where design thinking changed your product’s direction?

👇 Share your experience in the comments, and if you’d like to swap notes or collaborate on human‑centered product journeys, let’s connect. 💬✨

Founder Relationships Are Built Over Time

“Coming together is a beginning, staying together is progress, and working together is success.” — Henry Ford

I met Haripriya Bhagat in the very early days of eChai, almost 11 years ago. What started as meeting a like-minded woman in the neighbourhood slowly turned into running marathons together, supporting and learning from each other, making business introductions, and, in the process, creating a strong support system.

And that’s exactly what Jatin Chaudhary has consistently done with eChai Ventures, and what Harsha Bhurani is doing so thoughtfully in creating space specifically for women, building a community where relationships don’t end with an event. They compound. That’s the long game.

This particular event, with a new generation of builders in the room, reinforced something important:

Some people already have a seat at the table.

Some are building the table itself.

But the real question isn’t how the seat was secured. It’s how you show up once you’re there, how you contribute, add perspective, and earn respect over time by consistently adding value with the content.

Excited to see what Ahmedabad is becoming, and a huge shout-out to eChai Ventures for quietly and consistently contributing to the ecosystem.

I met Haripriya Bhagat in the very early days of eChai, almost 11 years ago. What started as meeting a like-minded woman in the neighbourhood slowly turned into running marathons together, supporting and learning from each other, making business introductions, and, in the process, creating a strong support system.

And that’s exactly what Jatin Chaudhary has consistently done with eChai Ventures, and what Harsha Bhurani is doing so thoughtfully in creating space specifically for women, building a community where relationships don’t end with an event. They compound. That’s the long game.

This particular event, with a new generation of builders in the room, reinforced something important:

Some people already have a seat at the table.

Some are building the table itself.

But the real question isn’t how the seat was secured. It’s how you show up once you’re there, how you contribute, add perspective, and earn respect over time by consistently adding value with the content.

Excited to see what Ahmedabad is becoming, and a huge shout-out to eChai Ventures for quietly and consistently contributing to the ecosystem.

When Small, Unplanned Things Shaped Meaningful Moments at an eChai Bengaluru Founders Event

Last week’s eChai event was one of those rare, wholesome experiences where everything just comes together. Low effort, unplanned yet incredibly beautiful and festive ✨ These are the moments that truly feel worth it.

And it wasn’t just one or two things, it was actually few super cool, completely unplanned highlights that made the evening special.

First, we decided to bring in a panel to clarify all the common doubts founders have around compliance, accounting and legal. Even before the main event started, we hosted a free legal and compliance clinic for our in-house entrepreneurs. Huge shoutout to our partners at The Startup Zone. Sharath Shyamasunder and his team spent more than five hours patiently helping startups sharing expert opinions and answering questions non-stop. (If you’re looking for these services, we highly recommend Startup Zone). DM me and I’ll be happy to put you in touch.

Second, we tried a D2C pop-up stall by Jalsa Snacks. What began as simple sampling turned into actual sales. The audience absolutely loved it and we didn’t charge anything because this was purely about supporting an early-stage entrepreneur and helping bring something beautiful to life. If you’re building a D2C brand and want to put up a stall, DM us, we’ve got your back.

And my favorite part, the real rockstars are the ones who don’t wait for opportunities they seize them. Aditya Mittal from Christ University, Bangalore main campus stepped up and moderated the event. Total Draper material. We’re genuinely rooting for this new talent who is going to own this space 🚀

None of this would have happened without the support of Jatin Chaudhary and The Startup Zone. Grateful for partnerships that truly show up and make things happen.

Looking forward to many more imperfect but beautiful moments like this. Such a great way to end the year just kidding, we still have seven amazing days to go. Let’s end the year on a high note.

And it wasn’t just one or two things, it was actually few super cool, completely unplanned highlights that made the evening special.

First, we decided to bring in a panel to clarify all the common doubts founders have around compliance, accounting and legal. Even before the main event started, we hosted a free legal and compliance clinic for our in-house entrepreneurs. Huge shoutout to our partners at The Startup Zone. Sharath Shyamasunder and his team spent more than five hours patiently helping startups sharing expert opinions and answering questions non-stop. (If you’re looking for these services, we highly recommend Startup Zone). DM me and I’ll be happy to put you in touch.

Second, we tried a D2C pop-up stall by Jalsa Snacks. What began as simple sampling turned into actual sales. The audience absolutely loved it and we didn’t charge anything because this was purely about supporting an early-stage entrepreneur and helping bring something beautiful to life. If you’re building a D2C brand and want to put up a stall, DM us, we’ve got your back.

And my favorite part, the real rockstars are the ones who don’t wait for opportunities they seize them. Aditya Mittal from Christ University, Bangalore main campus stepped up and moderated the event. Total Draper material. We’re genuinely rooting for this new talent who is going to own this space 🚀

None of this would have happened without the support of Jatin Chaudhary and The Startup Zone. Grateful for partnerships that truly show up and make things happen.

Looking forward to many more imperfect but beautiful moments like this. Such a great way to end the year just kidding, we still have seven amazing days to go. Let’s end the year on a high note.

The eChai Effect - In Their Words

“You don’t plan to build a company via eChai. You just keep showing up … and one day, you realize you did.” I’ve known Jatin since 2012, when I was still deciding what kind of second innings I wanted to play as an entrepreneur. Over the years, through events, chai breaks, intros, and seemingly small conversations, eChai helped shape not just Upsquare but also refined the lens through which we see collaboration. At Upsquare, we’ve hired talent, met partners, discovered co-investors, and built lifelong friendships. One of our joint ventures exists today only because a casual eChai memory sparked a deeper trust. Now, as we build House of Starts — our venture builder — eChai continues to fuel our mission: co-creating a shared future. eChai isn’t just a startup network. It’s a trust network. And for business builders like me, that makes all the difference."

Utpal Vaishnav

Founder @ Upsquare & House of Starts • Angel Investor + LP

"eChai is playing biggest role in my personal and professional life together. Its a community where i meet like minded people to share idea and learn from their idea. Even while playing cricket i learn something and i implement something new from that learning. Its my entry point for building network in different countries where my base is not established yet. Personally my only fun activity day in a week is eChai cricket and social."

yash shah

Chairman, ES Group of Companies

“When we launched LegalWiz.in back in 2016, concept of procuring legal and compliance services through a digital commerce platform wasn't as prominent in India. eChai played a significant role in providing the early adopters, and building significant positioning in the startup fraternity. Overtime, eChai grew to be a massive network of like-minded entrepreneurs and extended that benefit to all the members in a true "co-rise" spirit. I personally love to attend eChai events, learn from subject matter experts who share relatable and actionable insights and experiences. For startup journeys, it is so important to be surrounded by people who can add relevance, perspective, and push you to do better. Most importantly a group of people where you aren't being judged about things going right or wrong, but be a motivational force that keeps you going, yet keeping you in check. eChai is that place for me!”

Shrijay Sheth

Founder at LegalWiz.in and Hire4Higher Consulting

eChai Partner Brands

eChai Ventures partners with select brands as their growth partner - working together to explore new ideas, open doors, and build momentum across the startup ecosystem.