Founders, Investors, Enablers- Who are you listening to?

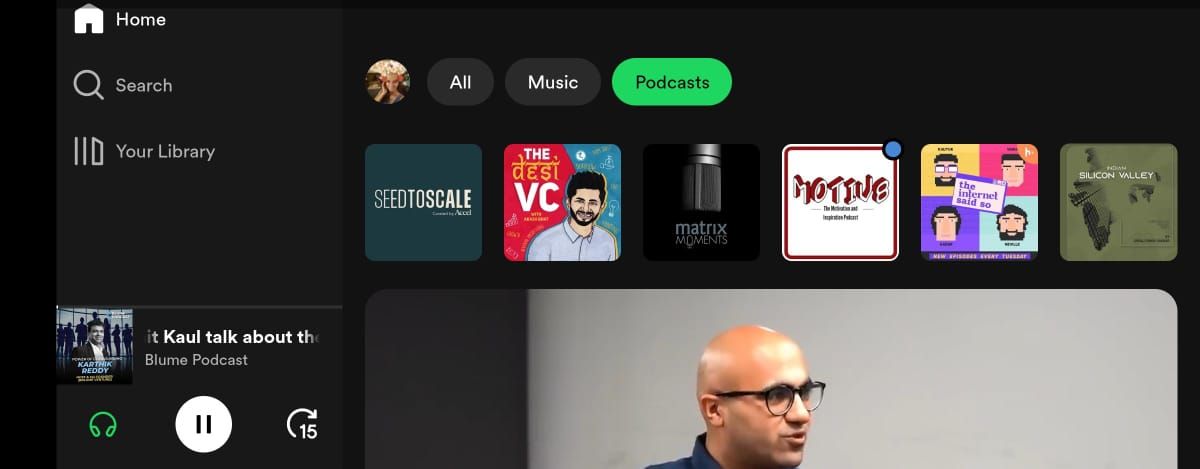

Over the last few weeks I've been constantly trying to rediscover learning through podcasts and here are some of them that are on my radar-

🎙 Seed to Scale by Accel - A podcast series highlighting the journey of various founders while launching a 2 podcast series with the Accel team from across the globe - Jim Swartz, Anand Daniel, Sameer Gandhi, Harry Nelis, Mahendran Balachandran celebrating their 40 years in the VC industry in 2023

🎙Blume Ventures podcasts - Season 1 on XUnicorns followed by Season 2 focusing on Power of Compounding where Karthik B. Reddy hosts founders like Peyush Bansal, Raamdeo Agrawal who have excelled at compounding from the last decade to almost half a century

🎙Matrix Moments by Matrix Partners India - Highlighting human capital while also discussing trends of 2023 and 2024 hosted by Rupali Sharma ranging to over 180 episodes over different seasons and topics

🎙DesiVC by Akash Bhat - Candid conversations with leading investors from across India with insights from Akash's journey as a founder and investor having spoken to 127+ people. This one has been on my list for over 3 years now

🎙Indian Silicon Valley podcast by Jivraj Singh Sachar- Intricate conversations with founders, investors, and enablers in the Indian start-up ecosystem spanning 161 episodes and more. Jivraj has been closely associated with the start-up and investment ecosystem bringing out his unique perspective through the questions he asks his guests

VCs have extensive insights and access to diverse information. They have access to insights ranging from an industry understanding brought together by cumulative team experiences, in-depth sector focus, and access to real-time information through their portfolio companies. Often these insights stay unshared or when shared, undiscovered by some of us. This year I'm on a mission to uncover some of the most insightful podcasts and will keep sharing as I keep listening.

So what are you listening to, to stay up to date? Drop startup and investing podcast recommendations in the comments. I'm sharing links to the ones I've mentioned above in the comments too.

Over the last few weeks I've been constantly trying to rediscover learning through podcasts and here are some of them that are on my radar-

🎙 Seed to Scale by Accel - A podcast series highlighting the journey of various founders while launching a 2 podcast series with the Accel team from across the globe - Jim Swartz, Anand Daniel, Sameer Gandhi, Harry Nelis, Mahendran Balachandran celebrating their 40 years in the VC industry in 2023

🎙Blume Ventures podcasts - Season 1 on XUnicorns followed by Season 2 focusing on Power of Compounding where Karthik B. Reddy hosts founders like Peyush Bansal, Raamdeo Agrawal who have excelled at compounding from the last decade to almost half a century

🎙Matrix Moments by Matrix Partners India - Highlighting human capital while also discussing trends of 2023 and 2024 hosted by Rupali Sharma ranging to over 180 episodes over different seasons and topics

🎙DesiVC by Akash Bhat - Candid conversations with leading investors from across India with insights from Akash's journey as a founder and investor having spoken to 127+ people. This one has been on my list for over 3 years now

🎙Indian Silicon Valley podcast by Jivraj Singh Sachar- Intricate conversations with founders, investors, and enablers in the Indian start-up ecosystem spanning 161 episodes and more. Jivraj has been closely associated with the start-up and investment ecosystem bringing out his unique perspective through the questions he asks his guests

VCs have extensive insights and access to diverse information. They have access to insights ranging from an industry understanding brought together by cumulative team experiences, in-depth sector focus, and access to real-time information through their portfolio companies. Often these insights stay unshared or when shared, undiscovered by some of us. This year I'm on a mission to uncover some of the most insightful podcasts and will keep sharing as I keep listening.

So what are you listening to, to stay up to date? Drop startup and investing podcast recommendations in the comments. I'm sharing links to the ones I've mentioned above in the comments too.

DevX Coworking Raises $ 7 Mn Funding

Funds to be used for national & global expansion

To add more assets across India with more than 2 Million Sq Feet area

On track to get listed next year

To build a Proptech solution for design & Build offering

DevX, Gujarat’s largest Managed Office Space provider, today announced that it has raised funding of $ 7 Million with a mix of equity & debt split equally. Family offices such as Urmin family office, Gala family office, Bidiwala family office already on captable participated in the equity round, which showcases testimony to the growth model, alongwith HNIs like Ajay Patel, Mitesh Patel and Soham Mehta; while Debt funding was provided by Banks & NBFCs.

Gujarat’s leader in the Managed office space segment, DevX is a co-working space cum accelerator founded in September 2017 by 3 entrepreneurs. The company was envisioned as a Startup Accelerator focussed on nurturing innovative startups by providing them with all requirements. Positioning DevX as an equal partner in growth, the company supports through their allied strategic partnerships and services. The different initiatives of DevX are thus structured to build synergies, enabling crosspollination of ideas as a means of collaborative growth and development. The company’s initiatives address different requirements across the value chain.

Speaking on the funding, Mr Umesh Uttamchandani, Co-Founder – DevX said, “This funding comes at a time when we are bullish on growth in both the national domestic & global markets. The funds will be deployed for giving further impetus to our national and global expansion goals. For India, this infusion of funds gives us the boost to add more inventory to grow vertically across cities – signing up Assets with more than 2 lakhs sq feet. Putting in place even stronger governance practices; we plan to get listed next year and also build a Proptech solution for design & build offering. We are proud to be setting standards for the segment to aspire to; with our stated business goal of being the partner of choice for GCCs (Global capability Centres) & ODCs (Offshore Development Centres). Growthcentric corporates are increasingly opting for managed workspaces, which perfectly meshes with our philosophy of offering best-in-class work-space experiences at competitive pricing.”

Opining on the event, Mr Devansh Majithia, Urmin Family Office said, “We are proud, yet again, to be part of this funding round. DevX’s innovative approach to providing an immersive, value drive experience for its tenants perfectly aligns with our own Investment philosophy. Their track-record of sustained growth and in-depth domain expertise have been core factors in driving our participation in this funding round”.

As a core part of the ecosystem, DevX also provides, round the year, a platform for industry, academia, professionals and companies to hold hackathons, seminars, events etc…to address trends and issues. The company is planning further expand and thus consolidate it’s pan-India presence by 2024 end.

.jpeg)

Notes for founders raising funds for the first time

BabyOrgano has raised the funds from DevX Ventures.

During our pitches to various investors, we've recognized that the transparency of our business model and the founder's honesty have been pivotal in garnering positive responses.

Key pointers:

BabyOrgano has raised the funds from DevX Ventures.

During our pitches to various investors, we've recognized that the transparency of our business model and the founder's honesty have been pivotal in garnering positive responses.

Key pointers:

- Clearly specify the fundraising goal and provide a detailed plan outlining how the funds will be strategically deployed in future initiatives.

- Demonstrate unshakeable confidence in your product idea and vision, even if it appears ambitious or unconventional to others.

- Prioritise transparency by openly acknowledging any potential challenges or drawbacks. Build trust with prospective investors through honest and straightforward communication.

#Throwback

🇮🇳 #Bangalore: Would you attend a startup demo day on a Saturday evening?

4 years since I last saw Jatin at DSH Singapore for eChai Ventures, we finally caught up IRL – this time co-hosting an eChai #startup pitch event and #investor panel discussion at DSH Bangalore. Our roof was filled with 130+ #entrepreneurs and investors.

Here are some learnings:

⏳45 DAYS to 6 MONTHS

Is the duration for which due diligence, getting a term sheet, to receiving money in the bank can take up to in the process of startups #fundraising (as a gauge) 🪙

📚 RESOURCES

– Venture Deals by Brad Feld is a great read to prepare founders who are #raisingcapital

– indianvcs.com is a pooled resource built by some VC folks, for entrepreneurs to have access to investor contacts (built with Notion 🔥)

🤝🏼 KEEP IT PERSONAL AND PROFESSIONAL

– Before reaching out to an investor, research on the fund and what they invest in.

– Be genuine and authentic. Dishonesty is a red flag; The industry is interconnected, and will soon find out 🚩

–

Seeing is believing. I wouldn't have imagined a pitch night on a weekend evening being full house, and the energy is uplifting.

Thanks a ton to the investors for their valuable insights (Vijetha, Himansu, Bikramjeet, Mohammed Amaan Memon) and all the entrepreneurs who came to share their vision and business ideas with us 🚀 ... Not forgetting one of the best hyper-connectors and startup enablers around: Jatin 💯

WHO SHOULD I MEET NEXT? 😁

I've been here for two weeks already, but will be based out of Draper Startup House #India for the next couple more – I'm happy to connect with #founders, #startups, #investors, ecosystem partners and would love to meet others who are also enabling the startup community! Thanks for the recs 🙌🏼

Loving this journey so far!

Stay tuned for updates from BLR 🇮🇳

🇮🇳 #Bangalore: Would you attend a startup demo day on a Saturday evening?

4 years since I last saw Jatin at DSH Singapore for eChai Ventures, we finally caught up IRL – this time co-hosting an eChai #startup pitch event and #investor panel discussion at DSH Bangalore. Our roof was filled with 130+ #entrepreneurs and investors.

Here are some learnings:

⏳45 DAYS to 6 MONTHS

Is the duration for which due diligence, getting a term sheet, to receiving money in the bank can take up to in the process of startups #fundraising (as a gauge) 🪙

📚 RESOURCES

– Venture Deals by Brad Feld is a great read to prepare founders who are #raisingcapital

– indianvcs.com is a pooled resource built by some VC folks, for entrepreneurs to have access to investor contacts (built with Notion 🔥)

🤝🏼 KEEP IT PERSONAL AND PROFESSIONAL

– Before reaching out to an investor, research on the fund and what they invest in.

– Be genuine and authentic. Dishonesty is a red flag; The industry is interconnected, and will soon find out 🚩

–

Seeing is believing. I wouldn't have imagined a pitch night on a weekend evening being full house, and the energy is uplifting.

Thanks a ton to the investors for their valuable insights (Vijetha, Himansu, Bikramjeet, Mohammed Amaan Memon) and all the entrepreneurs who came to share their vision and business ideas with us 🚀 ... Not forgetting one of the best hyper-connectors and startup enablers around: Jatin 💯

WHO SHOULD I MEET NEXT? 😁

I've been here for two weeks already, but will be based out of Draper Startup House #India for the next couple more – I'm happy to connect with #founders, #startups, #investors, ecosystem partners and would love to meet others who are also enabling the startup community! Thanks for the recs 🙌🏼

Loving this journey so far!

Stay tuned for updates from BLR 🇮🇳

Things to keep in mind during fundraising for early stage founders.

1. It is crucial to meticulously select a list of venture capitalists whose interests align with those of your company. This strategic alignment ensures that both parties are working towards common goals, thereby fostering a more fruitful and synergistic partnership.

2. View funding primarily as a catalyst for growth. Often, funds raised merely for the purpose of survival can lead a company into a detrimental cycle. Instead, focus on utilizing capital to accelerate development and expansion, thereby enhancing the company's long-term viability and success.

3. Be aware that certain aspects of your business may raise concerns or 'red flags' from an investor's perspective. It is imperative to continuously strengthen the 'green flags' or positive aspects of your venture. By reinforcing these strengths, you can effectively mitigate the impact of any potential red flags and present your business in a more favourable light to potential investors.

1. It is crucial to meticulously select a list of venture capitalists whose interests align with those of your company. This strategic alignment ensures that both parties are working towards common goals, thereby fostering a more fruitful and synergistic partnership.

2. View funding primarily as a catalyst for growth. Often, funds raised merely for the purpose of survival can lead a company into a detrimental cycle. Instead, focus on utilizing capital to accelerate development and expansion, thereby enhancing the company's long-term viability and success.

3. Be aware that certain aspects of your business may raise concerns or 'red flags' from an investor's perspective. It is imperative to continuously strengthen the 'green flags' or positive aspects of your venture. By reinforcing these strengths, you can effectively mitigate the impact of any potential red flags and present your business in a more favourable light to potential investors.

Things to keep in mind during fundraising for early stage founders.

There are no permanent ‘No’s. When an investor passed on your deal, ask for permission to keep them updated every quarter and then enrol them into a list to which you send out a quarterly update across your product, team and growth. You never know when interest in your startup might peak.

Fundraising is a full-time activity for 1 founder. Pitch to as many people as you can. Pitch, Ask for feedback, improve, repeat.

At early stages, valuation is more of an art than a science. Ultimately, when you are at the negotiating table - everything falls back to how desperate you are to raise and how convinced they are to invest in you.

There are no permanent ‘No’s. When an investor passed on your deal, ask for permission to keep them updated every quarter and then enrol them into a list to which you send out a quarterly update across your product, team and growth. You never know when interest in your startup might peak.

Fundraising is a full-time activity for 1 founder. Pitch to as many people as you can. Pitch, Ask for feedback, improve, repeat.

At early stages, valuation is more of an art than a science. Ultimately, when you are at the negotiating table - everything falls back to how desperate you are to raise and how convinced they are to invest in you.

.jpg)

Things to keep in mind during fundraising for early stage founders.

1) It is very important to know/understand when is the right time to raise funds. Don’t raise at the last minute else you won’t have any leverage. Also consider there may be multiple ways to increase your company’s cash including debt options

2) In the struggle between balancing funds and growing customers, try to focus on growing customers using any means necessary. Remember if there is growth, funds will follow.

3) During the process of raising funds, anything could go wrong. Don’t rest just because you have a signed term sheet. It’s never over until the funds are in your bank account.

4) Having some kind of leverage is the most important thing while raising funds.

You can have leverage if,

a) your growth is strong

b) multiple VCs are interested in putting money creating competitive situations

c) founders have a history of building successful companies before

1) It is very important to know/understand when is the right time to raise funds. Don’t raise at the last minute else you won’t have any leverage. Also consider there may be multiple ways to increase your company’s cash including debt options

2) In the struggle between balancing funds and growing customers, try to focus on growing customers using any means necessary. Remember if there is growth, funds will follow.

3) During the process of raising funds, anything could go wrong. Don’t rest just because you have a signed term sheet. It’s never over until the funds are in your bank account.

4) Having some kind of leverage is the most important thing while raising funds.

You can have leverage if,

a) your growth is strong

b) multiple VCs are interested in putting money creating competitive situations

c) founders have a history of building successful companies before

.jpg)

Do's and Don'ts of Fundraising for early stage founders.

Do's

- You should have a clear plan for atleast next 12 months that can be seen on excel sheet, which clearly shows, what this fund raise is going to achieve for you.

- Start the process 4-6 months before you actually need the funds

- Get an understanding of funds portfolio/thesis/decision making process by reaching their portfolio companies prior to pitching.

Don'ts

- Try not to mention about valuations untill explicitly asked. Do not become rigid on a number, try to negotiate and substantiate your number.

- Don't keep high hopes from 1 single investor, keep talking to multiple people at the time. But at same time be transparent about the options to them, whenever you start doing serious conversations on terms and stuff

- Do not mess your cap table with number of people, keep it as clean as possible, it makes your life much much more easy when raising next rounds!

Do's

- You should have a clear plan for atleast next 12 months that can be seen on excel sheet, which clearly shows, what this fund raise is going to achieve for you.

- Start the process 4-6 months before you actually need the funds

- Get an understanding of funds portfolio/thesis/decision making process by reaching their portfolio companies prior to pitching.

Don'ts

- Try not to mention about valuations untill explicitly asked. Do not become rigid on a number, try to negotiate and substantiate your number.

- Don't keep high hopes from 1 single investor, keep talking to multiple people at the time. But at same time be transparent about the options to them, whenever you start doing serious conversations on terms and stuff

- Do not mess your cap table with number of people, keep it as clean as possible, it makes your life much much more easy when raising next rounds!

Loved moderating this eChai Ventures gathering on Fundraising for Startups, with Shubham Jhuria and Dishan S Raao at Draper Startup House ❤️

Quoting an attendee who shared his feedback post event, "I feel my energy is revived after attending this and knowing that there are others just like me who are hustling, building and willing to help each other grow".

P.S. We used Cards Against Work by Plum at the start of the event to have a whole lotta fun!

Quoting an attendee who shared his feedback post event, "I feel my energy is revived after attending this and knowing that there are others just like me who are hustling, building and willing to help each other grow".

P.S. We used Cards Against Work by Plum at the start of the event to have a whole lotta fun!

eChai Partner Brands

eChai Ventures partners with select brands as their growth partner, helping them expand market reach, drive revenue growth, amplify brand visibility, and strengthen hiring efforts.

Employment Laws

ERP

Marketing Automation

D2C Brands

Ventrue Studio

Climate Tech

Event Marketing

Developer Tools

IT Hardware

FinTech and Financial Services

Web and Mobile Development

Creative and Marketing Agencies

Legal

CoLiving

Cloud Telephony

Investment Banking

Customer Engagement Platform

Blockchain Development

Coworking Spaces

FoodTech

FMCG Food and Retail

Marketing Tools

Healthcare

HR Tech and Agencies

Employment Laws

Marketing Automation

D2C Brands

Ventrue Studio

-

USP: We incubate and accelerate independent and integrated tech businesses.

Climate Tech

Event Marketing

Developer Tools

FinTech and Financial Services

Web and Mobile Development

Creative and Marketing Agencies

Legal

Cloud Telephony

Investment Banking

Customer Engagement Platform

Blockchain Development

Coworking Spaces

FMCG Food and Retail

Marketing Tools

Healthcare