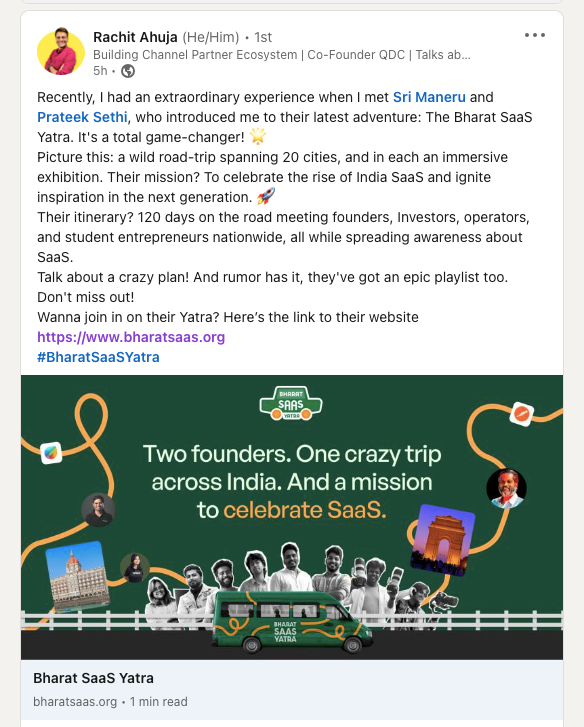

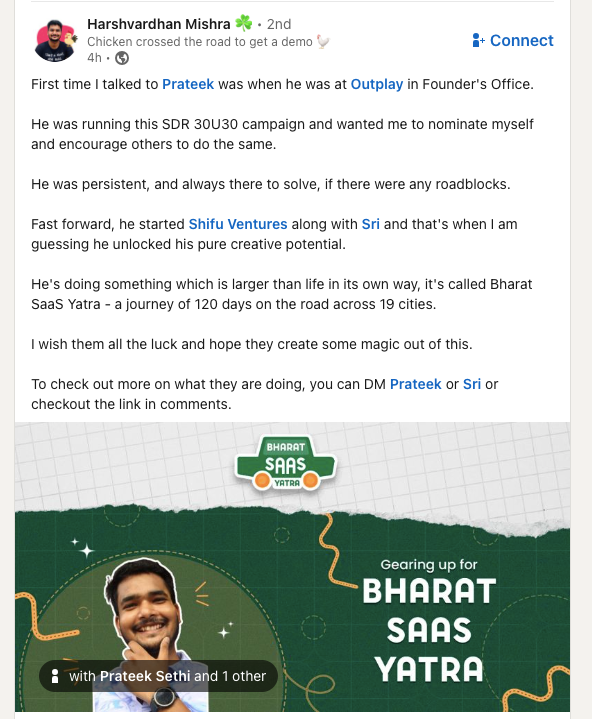

eChai's Singapore Startup Meetup is happening today (29th Feb, Thursday) at Draper Startup House Singapore from 7 pm to 9 pm.

🎙️

, Co-Founder, TrillionSale

🎙️

, Founder, Scout - AI Powered Talent Hunter

It will be moderated by

, Business Development Manager, IKIGAISG.

Free registration.

🎙️

🎙️

It will be moderated by

Free registration.

eChai's Startup Growth Networking Meetup in Ahmedabad is happening today evening at IIMA Ventures from 6 pm to 8 pm.

ft.

(iThink Logistics)

(Brands.live)

(Because)

(Venus Logistics)

(Saarthi Pedagogy)

I'll be moderating this meetup.

Free registration at eChai.Ventures

ft.

I'll be moderating this meetup.

Free registration at eChai.Ventures

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

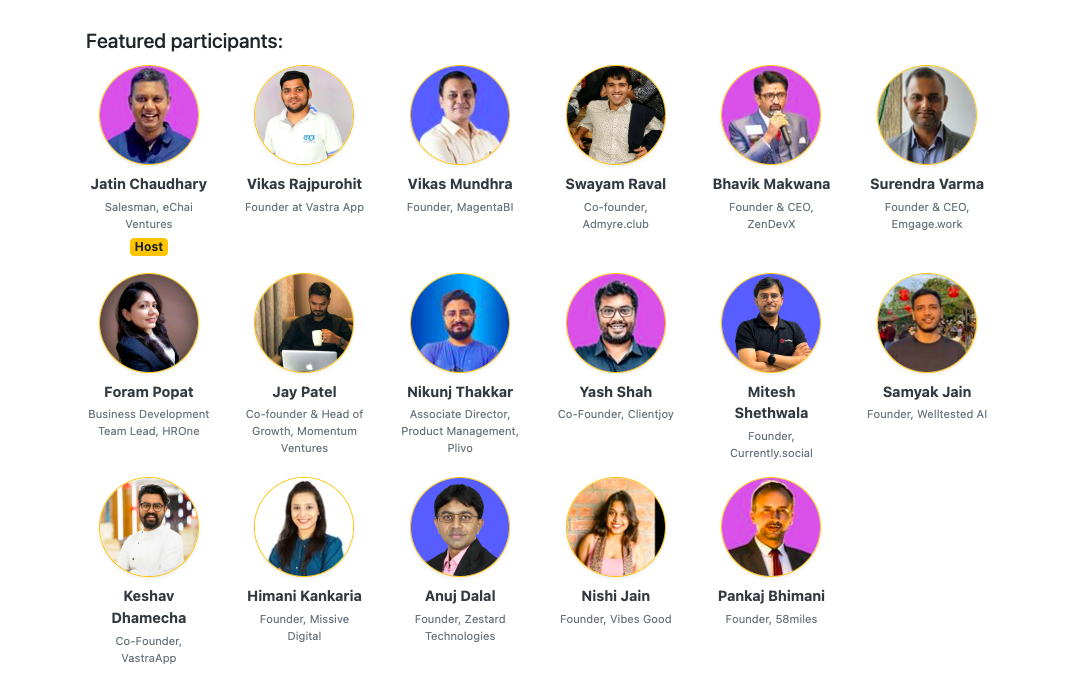

From the earlier eChai SaaS Social with founder friends from the city at MagentaInsights HQ.

Small Group. Candid Conversations. Startup Folks.

Great to catch up with many new founder friends from Ahmedabad.

Vikas Mundhra & Vikalp Somani (MagentaInsights)

Yash Shah (Clientjoy)

VIKASH RAJPUROHIT & Keshav Dhamecha (VastraApp)

Pankaj Bhimani (58Miles)

Kush Prajapati (Redicine)

Pratik Patel (Flo Mobility)

Himani Kankaria (Missive Digital)

Bhavik Makwana (ZenDevX)

Anuj Dalal (Zestard)

Mitesh Shethwala (Currently)

Harsha Bhurani (Hummingbird Consulting)

Jay Patel (Momentum Ventures)

Koumal Kalantry (Ankk Cares)

Swayam Raval (Admyre Club)

Nishi Jain (Vibes Good)

Niren Panchal (Brittman & Workex)

Foram Popat (HROne)

List of participants at https://echai.ventures/events/echai-saas-social-in-ahmedabad-feb-07-2024

We'll be hosting eChai's SaaS Social today evening in Ahmedabad.

Small Group. Candid Conversations. SaaS Folks.

We'll have parallel consumer business social also. Later on we'll have common gathering with both the groups.

More info at https://echai.ventures/events/echai-saas-social-in-ahmedabad-feb-07-2024

Notes from Startup Exits and M&A Forum

It’s important for both the companies - the company being acquired and the acquirer - to evaluate not just products, services and financials but also whether there is culture fit between the leadership and the team at large.

Due Diligence can bring to light compliance issues as well some times and it is ok. As long as it does not show gross negligence or mis-representation in data, Due Diligence typically goes through.

Diligence at the time of acquisition and diligence at the time of fund-raising are quite different. At the time of acquisition, it is much more focused on team, technology, GTM channels and financials while diligence at the time of fund raising is mostly legal and financial with some attention to other aspects.

It’s difficult for startups to plan for an exit. The plan should be created to become valuable for customers - everything else typically follows.

It’s important for both the companies - the company being acquired and the acquirer - to evaluate not just products, services and financials but also whether there is culture fit between the leadership and the team at large.

Due Diligence can bring to light compliance issues as well some times and it is ok. As long as it does not show gross negligence or mis-representation in data, Due Diligence typically goes through.

Diligence at the time of acquisition and diligence at the time of fund-raising are quite different. At the time of acquisition, it is much more focused on team, technology, GTM channels and financials while diligence at the time of fund raising is mostly legal and financial with some attention to other aspects.

It’s difficult for startups to plan for an exit. The plan should be created to become valuable for customers - everything else typically follows.

Things to keep in mind during fundraising for early stage founders.

There are no permanent ‘No’s. When an investor passed on your deal, ask for permission to keep them updated every quarter and then enrol them into a list to which you send out a quarterly update across your product, team and growth. You never know when interest in your startup might peak.

Fundraising is a full-time activity for 1 founder. Pitch to as many people as you can. Pitch, Ask for feedback, improve, repeat.

At early stages, valuation is more of an art than a science. Ultimately, when you are at the negotiating table - everything falls back to how desperate you are to raise and how convinced they are to invest in you.

There are no permanent ‘No’s. When an investor passed on your deal, ask for permission to keep them updated every quarter and then enrol them into a list to which you send out a quarterly update across your product, team and growth. You never know when interest in your startup might peak.

Fundraising is a full-time activity for 1 founder. Pitch to as many people as you can. Pitch, Ask for feedback, improve, repeat.

At early stages, valuation is more of an art than a science. Ultimately, when you are at the negotiating table - everything falls back to how desperate you are to raise and how convinced they are to invest in you.

.jpg)

Heading to Dubai! 🌍✈️

All set for SaaSBoomi Qafila ‘24 - a three-day exclusive initiative aimed at building an India-Middle East SaaS corridor.

At TechBridge Nation'24, we’re thrilled to showcase how Plutomen can be your strategic partner in XR-powered workforce transformation. The GCC market presents immense potential, and we’re eager to share insights on how Plutomen can contribute to the tech landscape in this region.

Join us from Jan 28th to Feb 6th in Dubai 📅!! Looking forward to connecting with industry leaders, innovators, and fellow enthusiasts. 🤝

All set for SaaSBoomi Qafila ‘24 - a three-day exclusive initiative aimed at building an India-Middle East SaaS corridor.

At TechBridge Nation'24, we’re thrilled to showcase how Plutomen can be your strategic partner in XR-powered workforce transformation. The GCC market presents immense potential, and we’re eager to share insights on how Plutomen can contribute to the tech landscape in this region.

Join us from Jan 28th to Feb 6th in Dubai 📅!! Looking forward to connecting with industry leaders, innovators, and fellow enthusiasts. 🤝

Para as autoridades chinesas, os cristãos são considerados um perigo para a nação. Chineses protestam contra o “Livro Branco”. (Captura de t...

eChai Partner Brands

eChai Ventures partners with select brands as their growth partner, helping them expand market reach, drive revenue growth, amplify brand visibility, and strengthen hiring efforts.

Climate Tech

FMCG Food and Retail

Investment Banking

Web and Mobile Development

Cloud Telephony

CoLiving

IT Hardware

FinTech and Financial Services

D2C Brands

Marketing Automation

Blockchain Development

Coworking Spaces

ERP

Creative and Marketing Agencies

HR Tech and Agencies

Employment Laws

Developer Tools

Marketing Tools

Event Marketing

Customer Engagement Platform

Healthcare

Legal

Climate Tech

FMCG Food and Retail

Investment Banking

Web and Mobile Development

Cloud Telephony

FinTech and Financial Services

D2C Brands

Marketing Automation

Blockchain Development

Coworking Spaces

Creative and Marketing Agencies

HR Tech and Agencies

Employment Laws

Developer Tools

Marketing Tools

Event Marketing

Customer Engagement Platform

Healthcare