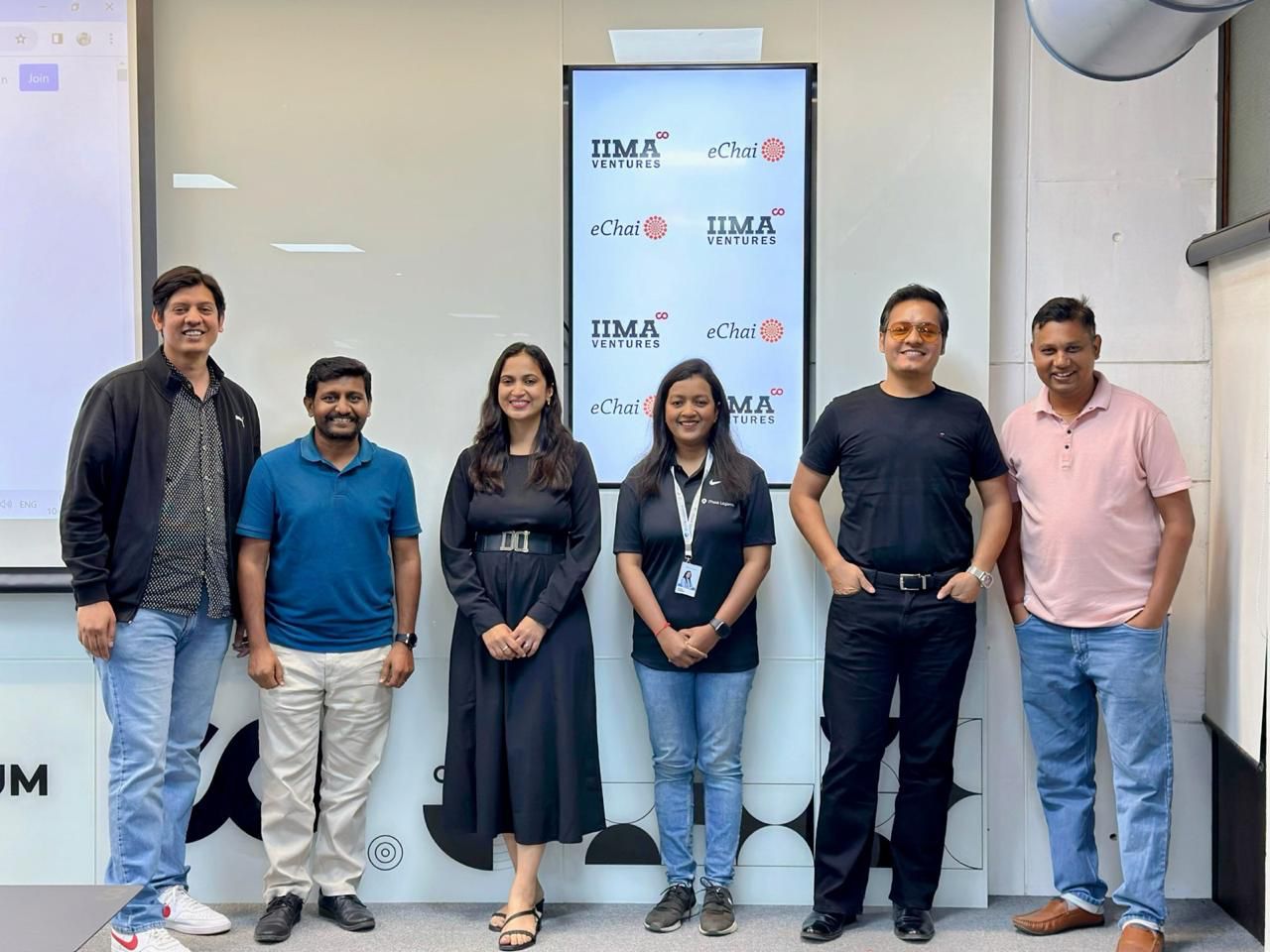

Yesterday, I had the privilege of attending an exhilarating session at the eChai's Startup Growth Networking Meetup, hosted by the dynamic Jatin Chaudhary at the prestigious IIMA Ventures, Ahmedabad.

Our panelists, each a trailblazer in their domain, shared their unique journeys and invaluable insights:

Zaiba Sarang from iThink Logistics is revolutionizing the logistics sector by significantly reducing product return ratios - a game-changer for brands.

Aditya Shah from Because demonstrated how they're helping brands carve their unique voice in a crowded market.

Vishakha Shah from Venus Logistics shared her experiences in the distinct US logistics market, creating substantial waves in the industry.

Sushil Agrawal's initiative, Saarthi Pedagogy, is impacting over 10 lakh students across India, revolutionizing the educational landscape.

The energy was palpable as young entrepreneurs eagerly engaged with the panelists, seeking wisdom on multitasking and effective management as founders.

Ziaba's anecdotes about customer feedback enhancing their product, Sushil's insights on fundraising, Aditya's take on cultivating a growth-oriented work culture, and Vishakha's candid sharing of the challenges faced by female entrepreneurs, added layers of depth to the discussion.

Kudos to Jatin Chaudhary for his relentless efforts and consistency in creating this one-of-a-kind platform that not only connects but inspires and empowers the startup community.

Our panelists, each a trailblazer in their domain, shared their unique journeys and invaluable insights:

Zaiba Sarang from iThink Logistics is revolutionizing the logistics sector by significantly reducing product return ratios - a game-changer for brands.

Aditya Shah from Because demonstrated how they're helping brands carve their unique voice in a crowded market.

Vishakha Shah from Venus Logistics shared her experiences in the distinct US logistics market, creating substantial waves in the industry.

Sushil Agrawal's initiative, Saarthi Pedagogy, is impacting over 10 lakh students across India, revolutionizing the educational landscape.

The energy was palpable as young entrepreneurs eagerly engaged with the panelists, seeking wisdom on multitasking and effective management as founders.

Ziaba's anecdotes about customer feedback enhancing their product, Sushil's insights on fundraising, Aditya's take on cultivating a growth-oriented work culture, and Vishakha's candid sharing of the challenges faced by female entrepreneurs, added layers of depth to the discussion.

Kudos to Jatin Chaudhary for his relentless efforts and consistency in creating this one-of-a-kind platform that not only connects but inspires and empowers the startup community.

Had an amazing time at eChai yesterday and came back with some gems that I just have to share. This place really shows that the more you share, the more you get back.

Here's what stuck with me:

1. *Go with Your Gut Feeling*:

from Brands.Live dropped this truth bomb - if you feel something's not gonna work, trust that feeling. Trying to push it when your gut says no? That's a no-go. It's all about trusting that inner voice.

2. *Asking Questions the Right Way*:

, the brain behind Saarthi Pedagogy, shared a killer approach:

- Are you even asking the right question?

- Are you asking the right question to the right person?

- And are you asking the right question to the right person at the right time?

Getting this right can really change the game.

These bits of advice are gold, making you rethink how you tackle things in your own journey.

eChai isn't just about giving; it's a place where you gain loads, especially in ways you didn't expect.

Here's what stuck with me:

1. *Go with Your Gut Feeling*:

2. *Asking Questions the Right Way*:

- Are you even asking the right question?

- Are you asking the right question to the right person?

- And are you asking the right question to the right person at the right time?

Getting this right can really change the game.

These bits of advice are gold, making you rethink how you tackle things in your own journey.

eChai isn't just about giving; it's a place where you gain loads, especially in ways you didn't expect.

Be the change you want to see!

Growing SOQO w little to nothing in a tier 2 city with a fledging startup ecosystem looked like the most impossible task, no one to look around, no one to aspire, no motivation and no empathy.

But that’s the thing, night is the darkest before sunrise. What you are seeking is seeking you, or do we say hungry hardworking entrepreneurs of Bhopal coming together for eChai Ventures Breakfast Social regularly every two weeks to be friends. No questions, no demands. Only good food, small groups and candid conversations.

My fav part of breakfast is morning energy of entrepreneurs, fresh and because we’re all in same boat hence without boundaries.

We talk. We talk about failure, getting into cycle of work after long break, mental health, hiring, lived experiences etc.

Good to just know, we’re all in same boat.

Wise words of Prerna Taneja today at the table “take it one day at a time”. And today was that one day we all met for nothing but meeting. :)

In frame

Sneh Nigam

Founder Mindcafe India

Meenal Rai Shejwar

Founder Amado

Vaibhav Kapoor

Director, RGIM Business School

Arihant Arya

Director, Glafix

HitartH Shrivastava

Founder, Bazarville

Co-Founder, F for Fries

Aman Talreja

Co-Founder, Seesaw

Kanika Gupta

Co-Founder, Seesaw

Amrita Bhama

Founder, Summer Stich

Prerna Taneja

Founder, The Zappy Box

and ofc me my and I haha, Founder SOQO

To many more breakfasts together!

Growing SOQO w little to nothing in a tier 2 city with a fledging startup ecosystem looked like the most impossible task, no one to look around, no one to aspire, no motivation and no empathy.

But that’s the thing, night is the darkest before sunrise. What you are seeking is seeking you, or do we say hungry hardworking entrepreneurs of Bhopal coming together for eChai Ventures Breakfast Social regularly every two weeks to be friends. No questions, no demands. Only good food, small groups and candid conversations.

My fav part of breakfast is morning energy of entrepreneurs, fresh and because we’re all in same boat hence without boundaries.

We talk. We talk about failure, getting into cycle of work after long break, mental health, hiring, lived experiences etc.

Good to just know, we’re all in same boat.

Wise words of Prerna Taneja today at the table “take it one day at a time”. And today was that one day we all met for nothing but meeting. :)

In frame

Sneh Nigam

Founder Mindcafe India

Meenal Rai Shejwar

Founder Amado

Vaibhav Kapoor

Director, RGIM Business School

Arihant Arya

Director, Glafix

HitartH Shrivastava

Founder, Bazarville

Co-Founder, F for Fries

Aman Talreja

Co-Founder, Seesaw

Kanika Gupta

Co-Founder, Seesaw

Amrita Bhama

Founder, Summer Stich

Prerna Taneja

Founder, The Zappy Box

and ofc me my and I haha, Founder SOQO

To many more breakfasts together!

From the earlier eChai SaaS Social with founder friends from the city at MagentaInsights HQ.

Small Group. Candid Conversations. Startup Folks.

Great to catch up with many new founder friends from Ahmedabad.

Vikas Mundhra & Vikalp Somani (MagentaInsights)

Yash Shah (Clientjoy)

VIKASH RAJPUROHIT & Keshav Dhamecha (VastraApp)

Pankaj Bhimani (58Miles)

Kush Prajapati (Redicine)

Pratik Patel (Flo Mobility)

Himani Kankaria (Missive Digital)

Bhavik Makwana (ZenDevX)

Anuj Dalal (Zestard)

Mitesh Shethwala (Currently)

Harsha Bhurani (Hummingbird Consulting)

Jay Patel (Momentum Ventures)

Koumal Kalantry (Ankk Cares)

Swayam Raval (Admyre Club)

Nishi Jain (Vibes Good)

Niren Panchal (Brittman & Workex)

Foram Popat (HROne)

List of participants at https://echai.ventures/events/echai-saas-social-in-ahmedabad-feb-07-2024

The journey of entrepreneurship with eChai Ventures has been like navigating through a maze illuminated by candid conversations.

It’s been 6/7 months of hosting much loved Breakfast Social in Bhopal. Building SOQO I always longed for a community, their insights, support and network.

While the path may not always be paved with gold, our small group meet-ups have been a beacon of hope.

Saw so many people collaborating outside our meet-ups. What little people understand about building community is faster returns on time spent.

They say together, we forge connections and share experiences, reminding ourselves that success is not just about going fast, but about going far - and going far together.

Here's to eChai Ventures for providing the platform for meaningful connections and collective growth.

Here’s to people who make it better, coz so much can be achieved by just showing up ✨

It’s been 6/7 months of hosting much loved Breakfast Social in Bhopal. Building SOQO I always longed for a community, their insights, support and network.

While the path may not always be paved with gold, our small group meet-ups have been a beacon of hope.

Saw so many people collaborating outside our meet-ups. What little people understand about building community is faster returns on time spent.

They say together, we forge connections and share experiences, reminding ourselves that success is not just about going fast, but about going far - and going far together.

Here's to eChai Ventures for providing the platform for meaningful connections and collective growth.

Here’s to people who make it better, coz so much can be achieved by just showing up ✨

Conversations going beyond businesses but all align to make businesses bigger n better.

It was fun being part of today’s eChai SaaS Social at Magenta Insights office.

One journey setting path for another journey. Problems/Challenges bringing people together for bigger - brighter and more productive solutions.

Thanks you

and

! cannot miss to mention - the happiness bell is such a motivating n cute thing.

Entrepreneurs present are great minds bringing innovative solutions.

And we all sneaked in for a quick photo shoot. Looks fab. Great places designed for best working - Devx.

Cheers

It was fun being part of today’s eChai SaaS Social at Magenta Insights office.

One journey setting path for another journey. Problems/Challenges bringing people together for bigger - brighter and more productive solutions.

Thanks you

Entrepreneurs present are great minds bringing innovative solutions.

And we all sneaked in for a quick photo shoot. Looks fab. Great places designed for best working - Devx.

Cheers

eChai Ventures New York will be hosting the small gathering of founders and startups folks on 16th February, Friday from 6.30 pm to 8.30 pm EST.

Typically Founders, Startup Enthusiasts, folks from VC firms and corporate folks interested in exploring startup ecosystem attend these eChai Startup Socials.

eChai Startup Socials are volunteer driven small gatherings with founders and startup folks happening all over the world.

These meetups are free to attend and open for all.

It will be on pay-for-what-you-order basis.

Format: Small Group. Candid Conversations. Startup Folks.

Date & Time: 16th February, January. 6.30 pm to 8.30 pm EST.

Venue: Mr. Purple, 180 Orchard St 15th floor, New York, NY 10002, United States

For any queries you can reach out to Harsh Thakkar, Co-Founder, Wall over WhatsApp at https://wa.me/19175920677

.jpg)

Conversations with startup founders can be so jam-packed with energy, insights, and ideas! And these are even richer in a casual setting, like at today's Social event by eChai Ventures.

It was a pleasure getting to know you,

and

! Your energy and mission are very inspiring - all the best for the road ahead. 😊

It was a pleasure getting to know you,

Honoured to be a part of this amazing panel alongside the amazing Ming Xia HO of Draper Startup House, Ramesh Loganathan of International Institute of Information Technology Hyderabad (IIITH) and Charu Dhyani of Pro Zero Carbon.

We will be speaking about the essence of community building in business. Join us today and bring on your questions.

RSVP:

https://lnkd.in/g3tfyK5U

We will be speaking about the essence of community building in business. Join us today and bring on your questions.

RSVP:

https://lnkd.in/g3tfyK5U

.png)

Notes from Startup Exits and M&A Forum

It’s important for both the companies - the company being acquired and the acquirer - to evaluate not just products, services and financials but also whether there is culture fit between the leadership and the team at large.

Due Diligence can bring to light compliance issues as well some times and it is ok. As long as it does not show gross negligence or mis-representation in data, Due Diligence typically goes through.

Diligence at the time of acquisition and diligence at the time of fund-raising are quite different. At the time of acquisition, it is much more focused on team, technology, GTM channels and financials while diligence at the time of fund raising is mostly legal and financial with some attention to other aspects.

It’s difficult for startups to plan for an exit. The plan should be created to become valuable for customers - everything else typically follows.

It’s important for both the companies - the company being acquired and the acquirer - to evaluate not just products, services and financials but also whether there is culture fit between the leadership and the team at large.

Due Diligence can bring to light compliance issues as well some times and it is ok. As long as it does not show gross negligence or mis-representation in data, Due Diligence typically goes through.

Diligence at the time of acquisition and diligence at the time of fund-raising are quite different. At the time of acquisition, it is much more focused on team, technology, GTM channels and financials while diligence at the time of fund raising is mostly legal and financial with some attention to other aspects.

It’s difficult for startups to plan for an exit. The plan should be created to become valuable for customers - everything else typically follows.

#Throwback

🚀 Recently, I had the opportunity to join an insightful panel alongside some incredible minds - Vandana Jain from Evident Capital, Priyank Jain, Co-founder of Soup-X, and the insightful moderator, Riten (Fueler).

Initially, I had my reservations, but thanks to Jatin Chaudhary's generosity in extending multiple invites, I decided to dive in. Grateful that I could overcome my inhibitions.

I questioned whether I could bring anything new to the table, considering my previous engagements on similar topics. It felt like everything I could share was already out there, accessible as playbooks or online courses. And as for my own and my brand's journey, well, it's right there on the internet for anyone to read.

But here's what this experience taught me:

1. Sometimes, we underestimate the value of our unique insights and journeys. We might think we've shared enough knowledge already, but there's always a fresh perspective or a new angle to offer. Your experiences are your own, and they can resonate with others on their own entrepreneurial journey.

2. The D2C space in India has indeed seen its fair share of repetition, especially in the post-COVID world. It's easy to fall into the same patterns and practices, but true pioneers stand out through innovation. Let's challenge the status quo and explore ways to set ourselves apart, beyond just products and sales channels.

Speaking at Draper Startup House and eChai Ventures event(s) is always a joy, and this time, it reminded me of the unique energy in Bangalore's startup ecosystem. It's an energy unlike any other, with an audience whose enthusiasm and thirst for knowledge were truly palpable.

And as we navigate the D2C landscape in India, let's remember that innovation, sustainable growth and authenticity are our guiding lights. While fundraising remains crucial, our focus should remain on building robust foundations, delivering exceptional customer experiences, and nurturing our long-term vision.

Here's to more enriching conversations and pushing the boundaries of D2C in Bharat! 🚀🇮🇳

🚀 Recently, I had the opportunity to join an insightful panel alongside some incredible minds - Vandana Jain from Evident Capital, Priyank Jain, Co-founder of Soup-X, and the insightful moderator, Riten (Fueler).

Initially, I had my reservations, but thanks to Jatin Chaudhary's generosity in extending multiple invites, I decided to dive in. Grateful that I could overcome my inhibitions.

I questioned whether I could bring anything new to the table, considering my previous engagements on similar topics. It felt like everything I could share was already out there, accessible as playbooks or online courses. And as for my own and my brand's journey, well, it's right there on the internet for anyone to read.

But here's what this experience taught me:

1. Sometimes, we underestimate the value of our unique insights and journeys. We might think we've shared enough knowledge already, but there's always a fresh perspective or a new angle to offer. Your experiences are your own, and they can resonate with others on their own entrepreneurial journey.

2. The D2C space in India has indeed seen its fair share of repetition, especially in the post-COVID world. It's easy to fall into the same patterns and practices, but true pioneers stand out through innovation. Let's challenge the status quo and explore ways to set ourselves apart, beyond just products and sales channels.

Speaking at Draper Startup House and eChai Ventures event(s) is always a joy, and this time, it reminded me of the unique energy in Bangalore's startup ecosystem. It's an energy unlike any other, with an audience whose enthusiasm and thirst for knowledge were truly palpable.

And as we navigate the D2C landscape in India, let's remember that innovation, sustainable growth and authenticity are our guiding lights. While fundraising remains crucial, our focus should remain on building robust foundations, delivering exceptional customer experiences, and nurturing our long-term vision.

Here's to more enriching conversations and pushing the boundaries of D2C in Bharat! 🚀🇮🇳

#Throwback

🇮🇳 #Bangalore: Would you attend a startup demo day on a Saturday evening?

4 years since I last saw Jatin at DSH Singapore for eChai Ventures, we finally caught up IRL – this time co-hosting an eChai #startup pitch event and #investor panel discussion at DSH Bangalore. Our roof was filled with 130+ #entrepreneurs and investors.

Here are some learnings:

⏳45 DAYS to 6 MONTHS

Is the duration for which due diligence, getting a term sheet, to receiving money in the bank can take up to in the process of startups #fundraising (as a gauge) 🪙

📚 RESOURCES

– Venture Deals by Brad Feld is a great read to prepare founders who are #raisingcapital

– indianvcs.com is a pooled resource built by some VC folks, for entrepreneurs to have access to investor contacts (built with Notion 🔥)

🤝🏼 KEEP IT PERSONAL AND PROFESSIONAL

– Before reaching out to an investor, research on the fund and what they invest in.

– Be genuine and authentic. Dishonesty is a red flag; The industry is interconnected, and will soon find out 🚩

–

Seeing is believing. I wouldn't have imagined a pitch night on a weekend evening being full house, and the energy is uplifting.

Thanks a ton to the investors for their valuable insights (Vijetha, Himansu, Bikramjeet, Mohammed Amaan Memon) and all the entrepreneurs who came to share their vision and business ideas with us 🚀 ... Not forgetting one of the best hyper-connectors and startup enablers around: Jatin 💯

WHO SHOULD I MEET NEXT? 😁

I've been here for two weeks already, but will be based out of Draper Startup House #India for the next couple more – I'm happy to connect with #founders, #startups, #investors, ecosystem partners and would love to meet others who are also enabling the startup community! Thanks for the recs 🙌🏼

Loving this journey so far!

Stay tuned for updates from BLR 🇮🇳

🇮🇳 #Bangalore: Would you attend a startup demo day on a Saturday evening?

4 years since I last saw Jatin at DSH Singapore for eChai Ventures, we finally caught up IRL – this time co-hosting an eChai #startup pitch event and #investor panel discussion at DSH Bangalore. Our roof was filled with 130+ #entrepreneurs and investors.

Here are some learnings:

⏳45 DAYS to 6 MONTHS

Is the duration for which due diligence, getting a term sheet, to receiving money in the bank can take up to in the process of startups #fundraising (as a gauge) 🪙

📚 RESOURCES

– Venture Deals by Brad Feld is a great read to prepare founders who are #raisingcapital

– indianvcs.com is a pooled resource built by some VC folks, for entrepreneurs to have access to investor contacts (built with Notion 🔥)

🤝🏼 KEEP IT PERSONAL AND PROFESSIONAL

– Before reaching out to an investor, research on the fund and what they invest in.

– Be genuine and authentic. Dishonesty is a red flag; The industry is interconnected, and will soon find out 🚩

–

Seeing is believing. I wouldn't have imagined a pitch night on a weekend evening being full house, and the energy is uplifting.

Thanks a ton to the investors for their valuable insights (Vijetha, Himansu, Bikramjeet, Mohammed Amaan Memon) and all the entrepreneurs who came to share their vision and business ideas with us 🚀 ... Not forgetting one of the best hyper-connectors and startup enablers around: Jatin 💯

WHO SHOULD I MEET NEXT? 😁

I've been here for two weeks already, but will be based out of Draper Startup House #India for the next couple more – I'm happy to connect with #founders, #startups, #investors, ecosystem partners and would love to meet others who are also enabling the startup community! Thanks for the recs 🙌🏼

Loving this journey so far!

Stay tuned for updates from BLR 🇮🇳

Things to keep in mind during fundraising for early stage founders.

1. It is crucial to meticulously select a list of venture capitalists whose interests align with those of your company. This strategic alignment ensures that both parties are working towards common goals, thereby fostering a more fruitful and synergistic partnership.

2. View funding primarily as a catalyst for growth. Often, funds raised merely for the purpose of survival can lead a company into a detrimental cycle. Instead, focus on utilizing capital to accelerate development and expansion, thereby enhancing the company's long-term viability and success.

3. Be aware that certain aspects of your business may raise concerns or 'red flags' from an investor's perspective. It is imperative to continuously strengthen the 'green flags' or positive aspects of your venture. By reinforcing these strengths, you can effectively mitigate the impact of any potential red flags and present your business in a more favourable light to potential investors.

1. It is crucial to meticulously select a list of venture capitalists whose interests align with those of your company. This strategic alignment ensures that both parties are working towards common goals, thereby fostering a more fruitful and synergistic partnership.

2. View funding primarily as a catalyst for growth. Often, funds raised merely for the purpose of survival can lead a company into a detrimental cycle. Instead, focus on utilizing capital to accelerate development and expansion, thereby enhancing the company's long-term viability and success.

3. Be aware that certain aspects of your business may raise concerns or 'red flags' from an investor's perspective. It is imperative to continuously strengthen the 'green flags' or positive aspects of your venture. By reinforcing these strengths, you can effectively mitigate the impact of any potential red flags and present your business in a more favourable light to potential investors.

Things to keep in mind during fundraising for early stage founders.

There are no permanent ‘No’s. When an investor passed on your deal, ask for permission to keep them updated every quarter and then enrol them into a list to which you send out a quarterly update across your product, team and growth. You never know when interest in your startup might peak.

Fundraising is a full-time activity for 1 founder. Pitch to as many people as you can. Pitch, Ask for feedback, improve, repeat.

At early stages, valuation is more of an art than a science. Ultimately, when you are at the negotiating table - everything falls back to how desperate you are to raise and how convinced they are to invest in you.

There are no permanent ‘No’s. When an investor passed on your deal, ask for permission to keep them updated every quarter and then enrol them into a list to which you send out a quarterly update across your product, team and growth. You never know when interest in your startup might peak.

Fundraising is a full-time activity for 1 founder. Pitch to as many people as you can. Pitch, Ask for feedback, improve, repeat.

At early stages, valuation is more of an art than a science. Ultimately, when you are at the negotiating table - everything falls back to how desperate you are to raise and how convinced they are to invest in you.

.jpg)

Things to keep in mind during fundraising for early stage founders.

1) It is very important to know/understand when is the right time to raise funds. Don’t raise at the last minute else you won’t have any leverage. Also consider there may be multiple ways to increase your company’s cash including debt options

2) In the struggle between balancing funds and growing customers, try to focus on growing customers using any means necessary. Remember if there is growth, funds will follow.

3) During the process of raising funds, anything could go wrong. Don’t rest just because you have a signed term sheet. It’s never over until the funds are in your bank account.

4) Having some kind of leverage is the most important thing while raising funds.

You can have leverage if,

a) your growth is strong

b) multiple VCs are interested in putting money creating competitive situations

c) founders have a history of building successful companies before

1) It is very important to know/understand when is the right time to raise funds. Don’t raise at the last minute else you won’t have any leverage. Also consider there may be multiple ways to increase your company’s cash including debt options

2) In the struggle between balancing funds and growing customers, try to focus on growing customers using any means necessary. Remember if there is growth, funds will follow.

3) During the process of raising funds, anything could go wrong. Don’t rest just because you have a signed term sheet. It’s never over until the funds are in your bank account.

4) Having some kind of leverage is the most important thing while raising funds.

You can have leverage if,

a) your growth is strong

b) multiple VCs are interested in putting money creating competitive situations

c) founders have a history of building successful companies before

.jpg)

Do's and Don'ts of Fundraising for early stage founders.

Do's

- You should have a clear plan for atleast next 12 months that can be seen on excel sheet, which clearly shows, what this fund raise is going to achieve for you.

- Start the process 4-6 months before you actually need the funds

- Get an understanding of funds portfolio/thesis/decision making process by reaching their portfolio companies prior to pitching.

Don'ts

- Try not to mention about valuations untill explicitly asked. Do not become rigid on a number, try to negotiate and substantiate your number.

- Don't keep high hopes from 1 single investor, keep talking to multiple people at the time. But at same time be transparent about the options to them, whenever you start doing serious conversations on terms and stuff

- Do not mess your cap table with number of people, keep it as clean as possible, it makes your life much much more easy when raising next rounds!

Do's

- You should have a clear plan for atleast next 12 months that can be seen on excel sheet, which clearly shows, what this fund raise is going to achieve for you.

- Start the process 4-6 months before you actually need the funds

- Get an understanding of funds portfolio/thesis/decision making process by reaching their portfolio companies prior to pitching.

Don'ts

- Try not to mention about valuations untill explicitly asked. Do not become rigid on a number, try to negotiate and substantiate your number.

- Don't keep high hopes from 1 single investor, keep talking to multiple people at the time. But at same time be transparent about the options to them, whenever you start doing serious conversations on terms and stuff

- Do not mess your cap table with number of people, keep it as clean as possible, it makes your life much much more easy when raising next rounds!

Yesterday, I had the privilege of participating in an insightful meetup organized by eChai and Venture Studio at Ahmedabad University, focused on Startup exits and M&A. The panel featured

from Tridhya Tech and

from Clientjoy, skillfully moderated by

from eChai and myself as a representative from IndiaBizForSale.

The audience comprised a diverse mix of management students, early-stage startup founders, professionals, and seasoned business owners. We delved into valuable discussions on the nuances of M&A experiences, sharing insights from various perspectives.

Clientjoy's recent acquisition by a strategic player and Tridhya Group's strategic acquisitions of nine companies provided rich learning opportunities. As a representative of Indiabizforsale, I had the chance to contribute our experiences, shedding light on exit plans, the pivotal role of investment bankers and outside counsels, dynamics of deal progress, and the strategic timing of exits.

Discussions also touched upon when not to consider an exit, the standard fee structure associated with such activities by investment bankers, and more.

Takeaways from the evening:

1. Team: If you lack previous M&A experience, seek outside counsel to avoid costly mistakes and stay on course during this potential roller coaster event.

2. Unlocking Value: M&A brings definite value unlocking for entrepreneurs, providing a sense of relief as they embark on new beginnings.

3. Role of Clean Bookkeeping and Clear Communication:Transparent communication is vital for sell-sides. Share an accurate company picture to preemptively address any discrepancies that may arise.

4. Reputation Risk: Acquirers, building a fair and forward-looking reputation, attract better deal flow. Unethical tactics may yield short-term wins but jeopardize future opportunities.

5. Due Diligence: The multifaceted Due Diligence (DD) process covers business, HR, financial, legal, tech, IP diligence, and industry-specific areas.

It was truly gratifying to engage with a diverse audience in the thriving Ahmedabad ecosystem, and I'm delighted to be part of the eChai Ventures community. Looking forward to more enriching interactions!

The audience comprised a diverse mix of management students, early-stage startup founders, professionals, and seasoned business owners. We delved into valuable discussions on the nuances of M&A experiences, sharing insights from various perspectives.

Clientjoy's recent acquisition by a strategic player and Tridhya Group's strategic acquisitions of nine companies provided rich learning opportunities. As a representative of Indiabizforsale, I had the chance to contribute our experiences, shedding light on exit plans, the pivotal role of investment bankers and outside counsels, dynamics of deal progress, and the strategic timing of exits.

Discussions also touched upon when not to consider an exit, the standard fee structure associated with such activities by investment bankers, and more.

Takeaways from the evening:

1. Team: If you lack previous M&A experience, seek outside counsel to avoid costly mistakes and stay on course during this potential roller coaster event.

2. Unlocking Value: M&A brings definite value unlocking for entrepreneurs, providing a sense of relief as they embark on new beginnings.

3. Role of Clean Bookkeeping and Clear Communication:Transparent communication is vital for sell-sides. Share an accurate company picture to preemptively address any discrepancies that may arise.

4. Reputation Risk: Acquirers, building a fair and forward-looking reputation, attract better deal flow. Unethical tactics may yield short-term wins but jeopardize future opportunities.

5. Due Diligence: The multifaceted Due Diligence (DD) process covers business, HR, financial, legal, tech, IP diligence, and industry-specific areas.

It was truly gratifying to engage with a diverse audience in the thriving Ahmedabad ecosystem, and I'm delighted to be part of the eChai Ventures community. Looking forward to more enriching interactions!

Recalling an enriching evening at the Hyderabad Startup Meetup, powered by eChai Ventures and hosted at The Headquarters! Gratitude to the esteemed panel members for sharing their expertise and making it a night of insightful discussions and collaboration.

Maithreye Murali Reddy Reena Sumera Srikanth Dhanwada Vishnu Chaitanya Kushagra Gupta

Maithreye Murali Reddy Reena Sumera Srikanth Dhanwada Vishnu Chaitanya Kushagra Gupta

🤝 Meeting incredible new minds and reconnecting with old friends—what a day it was filled with inspiring conversations! #Networking #NewConnections #Reunions

Vishnu Chaitanya,Gopi Krishna Gantala,Reena Sumera,Srikanth Dhanwada,Pradeep Reddy,Jatin Chaudhary,Dhruv Gupta,The Headquarters,Zepul,eChai Ventures,iTIC Incubator at IITH

Vishnu Chaitanya,Gopi Krishna Gantala,Reena Sumera,Srikanth Dhanwada,Pradeep Reddy,Jatin Chaudhary,Dhruv Gupta,The Headquarters,Zepul,eChai Ventures,iTIC Incubator at IITH

🇸🇬 Singapore: We appreciate everyone who joined us at the eChai Ventures event at Draper Startup House

#Singapore last night! Special thanks to Shilpa S Nath and Anna Rehermann for their valuable contributions as speakers and moderators 🙌

45+ amazing humans came together last night for the @eChaiVentures event at Draper Startup House in #Singapore to learn, share experiences, connect with each other, and to grow together as a community.

45+ amazing humans came together last night for the @eChaiVentures event at Draper Startup House in #Singapore to learn, share experiences, connect with each other, and to grow together as a community.

I had an amazing time engaging with fellow entrepreneurs and enthusiasts in the startup community. The atmosphere was charged with an extraordinary level of passion and energy.

A bit thank you to Jatin Chaudhary & eChai Ventures for organising it.

A shout out to Puneeth Suraana for being such a good moderator.

A bit thank you to Jatin Chaudhary & eChai Ventures for organising it.

A shout out to Puneeth Suraana for being such a good moderator.

· · ·

eChai Partner Brands

eChai Ventures partners with select brands as their growth partner - working together to explore new ideas, open doors, and build momentum across the startup ecosystem.